It’s worse than you think. “The odds of running out of money in retirement are significantly greater than prior studies had concluded,” according to a recent Market Watch article.

This concern was identified by Edward McQuarrie, professor emeritus at Santa Clara University in his research that looked at historic periods in which U.S. retirees struggled to maintain their standard of living. What year was the worst? No, it wasn’t during the ’29 or ’87 market crashes, or the Great Recession of 2008. It was 1965 because “both the stock and bond markets embarked on a sustained period of negative inflation-adjusted returns.” Thus, he concluded that today’s retirees are in danger of outliving their money.

But he also identified a few ways to reduce the odds.

One suggestion that caught my attention (of course) was the addition of residential real estate to a retiree’s/near retiree’s portfolio. He added that historical data is limited, but he concluded that “the addition of real estate … was generally successful” adding that for investors outside the U.S. it was “sometimes remarkably so.”

According to the article, McQuarrie indicated that the key is how the real estate holdings perform. And that’s where Lloyd Jones comes in. As an owner/operator, we are proactive in the management and asset management of our real estate assets. Our investors know that through our intense underwriting and hands-on management, our investment track record of investor returns is outstanding.

Recently, we have adjusted our approach. For the past ten years, the play has been value-add multifamily real estate. We acquired apartment communities, upgraded them, enjoyed the income – and really enjoyed the appreciation. But now we are selling because caps rates are falling to crazy levels. With yields about five to six percent, it’s time to look at new opportunities.

And there are opportunities – fabulous opportunities to provide you added income in your retirement.

1) Senior housing. The past few years with Covid have devasted the industry with low occupancies and rising labor costs. But there has been virtually no new product. And now, we are recovering, and the demand has surpassed supply – radically. And there has been no construction to meet the current demand. And within the next five years, the tsunami of baby boomers requiring assisted living will be upon us. Then what? (The oldest baby boomers turned 75 last year; entrance to senior housing begins at about 80.) Even with a massive expansion of construction activity, there will still be a supply shortage. It’s time to invest in senior housing. You can expect to earn a yield of approximately 8%.

2) The other opportunity we are excited about is the hotel industry -another victim of Covid. We are focusing on extended-stay opportunities. In the right location, and with the right oversight, they will yield about 10% annually. Sometimes, they can be converted to senior housing (and in a lot less time than it takes to build from the ground up). Lloyd Jones has created a new hotel acquisition division to aggressively analyze investment opportunities.

We invite you to join us as we take advantage of this very timely- and exciting – opportunity.

Visit lloydjonesllc.com for current investment opportunities.

The opportunity is irresistible. Everything points to an incredible rebound in senior housing starting right now and lasting for the next several decades. It is time to invest in senior housing.

Back in 2018 and 2019, the assisted living/memory care sector was overbuilt. Occupancy was suffering.

Then came Covid. 2020 and 2021 devastated senior housing. Occupancy rates fell. Staffing was difficult – and expensive. Lower interest rates were offset by higher operating expenses and lower occupancy.

Now, it’s 2022. And we’re recovering. And we have four years of built-up demand because there’s been no new supply of senior housing. Demand has caught up with supply. And it takes at least two years to construct a new community. So, the demand will continue. The future of senior housing looks incredible!

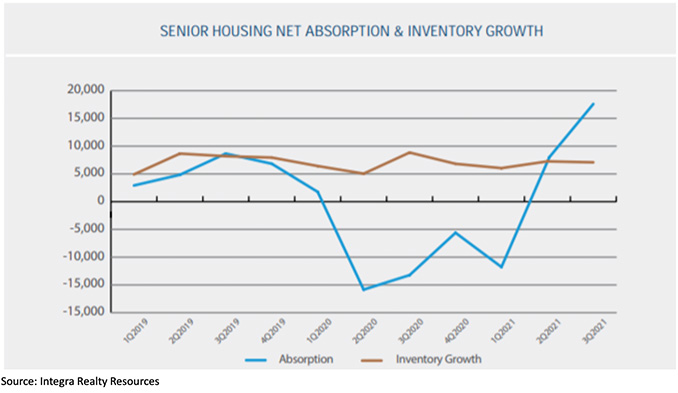

Look at this graph!

A report by Integra Realty Resources has forecast that “senior housing demand will increase sharply through 2023, with pent-up demand filling the void.”

And then the baby boomers are coming!!! The oldest baby boomers turned 75 last year. Seniors enter senior housing at about 80 years old, so within the next five years, the tsunami will hit! And Lloyd Jones will be ready.

Join us as we invest in senior housing. It’s something we have been doing for many years, but this is beyond any previous opportunity. Visit lloydjonesllc.com to see our current opportunities.

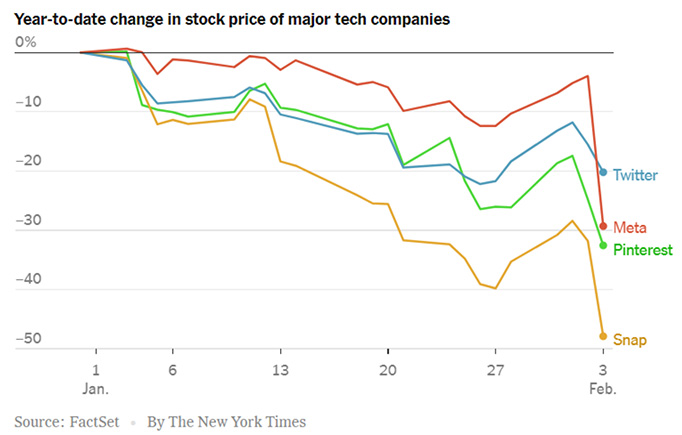

What if this had been your retirement portfolio?

Granted, the graph can reverse itself tomorrow; that’s the nature of the stock market. But do you want to gamble your retirement savings on it?

There is a better solution. Senior housing is poised for an extraordinary run. For the past four years there has been no senior-housing development. No new product. Covid stalled the industry with falling occupancies, increasing labor costs.

But today, we’re recovering, and it’s a different story. The demand has surpassed supply – drastically. The absorption rate is going straight up. A report by Integra Realty Resources has forecast that “senior housing demand will increase sharply through 2023, with pent-up demand filling the void.”

And that demand doesn’t include the oncoming tsunami of baby boomers, the oldest of which just turned 75 last year. The average senior-housing entrance age is about 80, so the demand in the next five years will be incredible – and there’s no supply. It takes at least a couple of years to develop a new community, so the demand will continue.

So, I invite you to join us as we invest in senior housing. We have added two new properties to our senior portfolio in the past couple of weeks and have more on the books. Your investment will earn you a reliable 8% or so, and it will be steady – no peaks and valleys like the stock market.

For details on senior housing opportunities, visit https://lloydjonesllc.com.

My dad is a big man. He’s a big, 67-year-old man. And he fell in the shower. Mom called 911.

My parents live in a ubiquitous colonial-style, two-story home. It’s an old home where they raised my brothers and me. It’s full of nooks and crannies and secret hiding places, but it’s also full of narrow hallways, steep staircases, and upstairs bedrooms.

Navigating the sharp angles and the precipitous staircase was a challenge for the EMTs, but they got Dad to the hospital where he was treated. He’s now home, temporarily confined to a wheelchair – and the living room.

He can’t go up the stairs to his bedroom, or down to his beloved “man-cave” in the basement. He’s in the living room where he spends his nights sleeping on a recliner. His wheelchair takes him to the kitchen, but he can’t reach the cupboards where Mom hides the cookies. He can’t even reach the light switches without a struggle. He’s not happy.

Time for a family conference. Is this just the beginning? What if this were not temporary?

It’s hard to imagine because my parents are active and healthy. Mom loves her tennis and lunch with her friends. Dad works out every day, runs half marathons, and enjoys an occasional beer with his buddies. But it’s something to think about.

As people age (and they will), stairs become more difficult to climb, doorknobs become harder to turn, and showers become slippery. Even for the most fit, home and yard maintenance can become overwhelming and even dangerous.

My parents love their home. It’s full of memories; it’s close to neighbors. They intend to live here forever, to gracefully age in place. But let’s be realistic. Climbing stairs and ladders is not safe as people grow older.

Back to the family conference. What should we do? Can we renovate the home to make it accessible and safe for the rest of their lives? Should we encourage Mom and Dad to move to an active-adult senior community?

I ran across an article by Glenn Ruffenach in the Wall Street Journal entitled “How to Decide Whether To Move or Stay in Your House in Retirement.” Perfect. The article addresses the exact issues we are facing – and then some.

Homes can be remodeled and retrofitted, he says. But there’s more to consider than grab bars and first-floor bedrooms.

For instance, the expense. It can cost tens of thousands of dollars to retrofit your home. Think if that is how you want to spend your retirement money. He goes on to say that a home retrofitted specifically for senior living may not be attractive to younger families when it comes time to sell the home.

Next, he mentions transportation. Mom and Dad live in the country, in a small town. They drive everywhere, to doctors’ appointments, to restaurants and shopping, to see friends. According to Mr. Ruffenach, the AAA has indicated that seniors are outliving their ability to drive safely by seven to ten years. At some point, that might apply to my parents. And frankly, I hope they do live that long, even without a driver’s license. But they could no longer live independently.

Thirdly, he mentions socialization. I read frequently about how important this is in seniors’ lives. In fact, isolation is a leading factor in the mortality rate. My parents are very social. They have lots of friends, and my brothers and I visit often. But what if they can’t drive to see their friends?

An active adult community would offer all the socialization and activities they could possibly want, albeit with new friends. Either way, I suspect they will always remain socially active.

Finally, he hesitatingly mentions spouse and family. If one spouse dies, would the surviving spouse be better off in the current home or a senior community? He warns that this is a very important decision to make sooner, rather than later. Whether you choose to renovate your home or to move, he says, make the decision while it’s still your decision to make. If you fail to act while you are mentally and physically strong, someone else will make the decision for you.

As much as my parents love my brothers and me, I know they want to be independent and make this decision themselves. They probably have lots of time, but the 911 call scared me.

-The Oldest Daughter

Do your kids –and yourself -a favor. Clean out your attic, your cupboards, and your closets. Don’t leave that burden to your kids.

As we age, our homes become too big, too much work, and often unsafe. At some point we will have to move, sometimes willingly, sometimes not. More and more seniors are being proactive, choosing to downsize to an active adult community while they can still enjoy the new lifestyle. A new lifestyle without shoveling snow, cleaning gutters, climbing ladders, or even climbing stairs.Maybe even a lifestyle with dining and housekeeping.

It could be a wonderful opportunity. But getting there from here can be a daunting task. And even more daunting would be an emergency that precipitated a quick move.

When downsizing, it seems we have three choices: fight it until it’s absolutely necessary and become overwhelmed with the prospect; do nothing and saddle our children with hard decisions and the burden; or the wisest, start early and plan for an exciting new lifestyle.

But this requires discipline. You have to start today, not“when you have time” or “someday.” You can start small. If you buy a new toaster, dump the old one. Break the handle off a cup? Throw it out; don’t save it hoping to get around to gluing it. Then tackle that collection of telephone books; old, dried paint cans; broken furniture you had hoped to refinish.

In the meantime,

First, call your kids. Do they have any interest in your grandmother’s crystal? Or your collection of bobble-heads? Give them an opportunity to label items for future reference (or to take now). You might be surprised at what is important to them –and what is not. Even your most sentimental child may not want anything to do with your wedding silver if it has to be polished.

Clean out drawers, file cabinets. Throw away anything that you don’t absolutely need: a property appraisal when you bought your house 20 years ago; tax returns of 1950. Do you really need that yellowed letterhead from the previous address? How many outdated dresses are in your closet “just in case” an occasion arises?

Talk to an estate-sale expert. What do you do with your furniture and collectibles? These people can be a great help and comfort in your decision making, especially with china, silver, and crystal. They can arrange off-and on-site estate sales and offer you professional, objective advice.

Plan a yard sale or call your friends to thin out your furniture. Your furniture will sell for pennies on the dollar if you have to give it to a consignment shop. So, try to sell it first. Look around your home. If you could move only a few pieces, which would they be? Chances are, even in a luxury senior community, your home will not be as large as the one in which you raised your family. You don’t have to sell everything now and live at your kitchen table; just be prepared.

One day, most of us will have to make a decision about where we will spend the rest of our lives. Chances are it will not be in the big family homestead. So be proactive. Be prepared. Do yourself –and your kids -a favor so when the opportunity/necessity arises, your move can be (relatively) stress-free.

The senior housing industry is in the midst of a big disruption. Occupancy in assisted living hit a record low in the first quarter of 2018 – and continues to fall. There could be numerous reasons for this, including a bad flu season, but I think there’s something bigger going on.

At a recent conference I attended, one of the speakers addressed this subject. He suggested that two major influencers are driving the disruption.

- Labor shortage. A labor shortage is anticipated for high-intensity facilities such as assisted living, memory care, skilled nursing facilities. The average wage for a CNA (certified nursing assistant) is currently $11 per hour. Soon, the speaker projects, it will be $15. This will cause an 8% drop in NOI which translates to a 27% decline in asset value! Or, more likely, rents will rise, and such facilities will become even less affordable.

- Technology. And this is where it gets cool! Technology is focusing on aging-in-place, allowing seniors to avoid institutional facilities longer. The speaker shared that aging-in-place technology will become a $7 trillion economy. Venture capital is investing 10:1 on technology versus operational improvements.

So how does this affect you and me?

It means we can age in place almost anywhere. The secret is in choosing the place. If we live long enough, each of us will need assistance at some point, (although most of us refuse to admit it). But technology will allow us to live wherever we choose with on-demand assistance as necessary.

Even today, technology is available to get us what we need, when we need it: a voice activated communications system connected with family or emergency-response team; a sensor to monitor activities and detect irregularities; a wrist band connected to an AI platform that alerts the doctor if anything is out of kilter; apps to remind us to take our pills; apps to call a ride; apps to order meals; apps to request assistance with dressing or bathing; apps for help hanging pictures or rearranging furniture.

And that’s today. Just wait until that $7 trillion investment is realized!

I project the future of senior housing will be focused on the independent-living model with limited services – which will be offered a-la-carte. Technology will replace the need for personal assistance. We will not need (nor can most of us afford) the full staff that comes with assisted-living facilities. With this exciting new technology, we will remain independent much longer as we age in place.

But aging-in-place doesn’t mean staying in your four-bedroom colonial with stairs, narrow doorways, and slippery bathtubs. Forward-thinking baby boomers are eschewing their large family homesteads that require constant up-keep and high taxes for luxury apartment living. Here, they can age in place, but in a place with more amenities, more fitness activities, more social involvement, and more companionship. And that socialization is very important. Studies show that social isolation increases the risk of death by 30%; some show it as high as 60%!

Assisted living and memory care facilities, of course, will still be needed, but they will have a much higher cost and be even less affordable to the average senior. That said, senior housing still ranks as the most attractive property class for investment according to a recent survey of commercial real estate owners, managers, developers, and lenders.

So, we will age, in place, independently, and wherever we want. And I suspect most of us will choose an independent-living community surrounded by like-minded, active, involved friends – and cool technology!

Christopher Finlay is Chairman/CEO of Lloyd Jones, a real estate investment firm that specializes in the multifamily and senior housing sectors. Based in Miami, the firm acquires, develops, improves, and operates multifamily and senior housing communities in growth markets throughout Texas, Florida, and the Southeast. The firm’s investment partners include institutions, family offices, and individual accredited investors.

“The golden era [of stocks and bonds] has now ended,” says a McKinsey & Company report issued last year.

The report suggests that returns on equities and fixed-income investments could see significant decreases – up to 400 or 500 basis points over the next twenty years. According to the report, this will affect everybody, from pension funds that will face larger funding gaps; asset managers who will see lower fees; and insurers whose earnings depend on investment income. And on a personal level, the new generation of retirees will retire later and with less income.

And more recently, Bloomberg reported that “U.S. markets are at their highest risk levels since before the 2008 financial crisis… according to Bill Gross, manager of the $2 billion Janus Henderson Global Unconstrained Bond Fund.” The article continues, “Gross said that ‘…returns are going to be lower.’” These thoughts are echoing throughout the industry.

To prepare for the new era, investors are looking at alternatives. Many are choosing real estate. And with good reason. In fact, as far back as 2012, a JP Morgan paper suggested that real estate is no longer an alternative, but rather a “way out.” “An alternative no more.” Just look at the endowment portfolios of major academic institutions, led by Yale whose successes are legendary. Yale has allocated 12.5% of its investment to real estate.

Maybe it’s time for you to consider diversifying your investment portfolio by adding real estate. Why?

Reduced Volatility

Real estate is stable, unlike the stock market that reacts to every nuanced whisper in politics or the economy. It is not correlated to the stock and bond markets. Real estate offers a steady, reliable return. Studies show that, by adding real estate to a mixed portfolio, you will see an increase in returns and, perhaps even more important, a reduction of risk based on return/unit of risk.

I’m not talking about a REIT. A REIT is like a stock; it goes up and down with the equity markets. I’m talking about a direct investment in private equity joint venture or a fund.

Cash Flow

Cash flow is the key. You should receive, at the very least, six-plus percent annual return on your investment. Our goal in today’s market is yield – a reliable, on-going cash flow return.

And this is not about short term. The days of “fix and flip” passed us a couple of years ago. Now, we hold our properties for several years while enjoying the steady cash flow and substantial appreciation.

We factor anticipated inflation into our underwriting projections. We expect an increase in expenses, and we project an increase in rents to cover them. Remember, real estate is a hard asset. As new construction costs increase, the cost of replacing the existing structure also rises (along with its value) creating yet another potential hedge against unanticipated inflation.

When you get your money back, it is treated as capital gain, a favorable tax rate.

The Private-Equity Real Estate Fund

We like funds. You will, too. But it is important to focus – and to focus on an asset class your partner knows and understands.

Focus

At Lloyd Jones Capital, our focus is middle-income housing. It’s what we have been doing for years. According to virtually every demographic study, the supply will never catch up to the demand.

And we focus on Texas and the Southeast, home to ten of the 15 fastest growing cities plus seven of the ten “best cities for job growth.” We like to be where the people like to be. Plus, we have existing operations throughout these markets.

Diversification

We like funds because you can spread the risk among various properties and geographic markets. A disappoint-ing performance of one asset will not affect the others. In fact, the others will most likely compensate for it.

We like eight to ten properties in four or more different markets for maximum diversification. We have operations in every market we serve, and our local presence gives us tremendous advantage in finding, acquiring, and operating properties within these territories.

Stand-Alone Entities

Our fund structure allows us to hold our investments property by property. Each one operates as a separate business. There is no cross-collateralization. A market slow-down in one area will not affect the other properties. We prepare a business plan for each specific property, and we can choose individual hold terms and disposition times.

Alignment of Interest

We believe in our investments; we are thoroughly committed to them, so we participate financially in every one, alongside our investors.

So, what’s an investor to do?

I suggest that we all heed the words of today’s best-known economists and be prepared for the unknown future of the equity and fixed-income markets. It would be wise to diversify your portfolio with multifamily real estate. Private-equity real estate offers protection from stock market swings and a hedge against inflation. It provides a steady cash flow, appreciation, and great tax advantages. What other asset class can say that?__________________________________________

About Christopher Finlay

Christopher Finlay is chairman/CEO of Lloyd Jones Capital, a private-equity real estate firm that specializes in the multifamily sector. For the past thirty-seven years, and through every economic cycle, he has owned and operated successful multifamily businesses. Predecessor companies include commercial brokerage, appraisal, property and asset management, construction, and development.

Headquartered in Miami, Lloyd Jones Capital acquires, improves, and operates multifamily real estate in growth markets throughout Texas, Florida, and the Southeast on behalf of institutional partners, private investors, and its own principals.

Once upon a time, not so long ago, the American dream was to own a modest home in which to raise a family. This was more than a dream; it was an assumption, an expectation. Even the lowest-income workers aimed for and usually achieved, this dream. Not anymore. There is a tremendous last of affordable housing. Millions of our working families cannot even afford a rental apartment.

But that can change. I submit that we can double affordable housing assistance without increasing funding. We currently spend

$50 billion for affordable housing programs

plus

$130 billion to assist non-low income households via tax deductions

Billions. That’s a lot of money. Where does it go?

1. Affordable housing.

Federal and state governments have literally hundreds of programs designed to provide housing assistance – $50 billion worth. This massive bureaucracy comes at a tremendous cost to efficiency, and it meets the needs of only a fraction of the very-low-income population. Plus, it drives up the costs.

2. Assistance for home-owners

We spend $130 billion to assist non-low- income households through mortgage interest and real estate tax deductions. $130 billion to home-owners when we have homeless families?

I’ve just finished reading a 2015 report by the Congressional Budget Office (Federal Housing Assistance for Low-Income Households). It looks at several potential policy changes to address the problem of affordable housing: revising the composition of the assisted population, adjusting tenant contributions to the rent payment on HUD’s voucher program, and repealing and/or replacing various programs. (Just repealing the LIHTC [Low Income Housing Tax Credit] program would increase revenues $42 billion over the next 10 years per the Joint Committee on Taxation.)

This CBO report is an analysis of various options; it offers no solutions. I propose an additional option, but first, we have to address the real issue.

The real issue:

In my opinion, these options do not address the underlying problem: the massive bureaucracy inherent in any government program. Layer upon layer of bureaucracy: administration, multi-tiered approvals, pages and pages of legislative rules and regulations, legal fees, accounting fees, compliance fees – and record maintenance into perpetuity. In one of my LIHTC compliance newsletters, the writer took over 350 words to explain “simply” which income limits to use to qualify a household. If it takes 350 words to tell me which year’s income limits I must use, it’s not simple. It takes attorneys, accountants, and compliance experts to understand the intricacies of each program. How many thousands of people are involved in every project? It’s very expensive to produce affordable housing. I recently read that the cost to construct a low-income housing tax credit unit is $250,000 – for one unit!! I suspect that same unit, market rate, would come in around $150,000.

My Proposal: Let’s dismantle the entire bureaucracy!

Let’s use the funds – from all sources – and provide assistance directly to the end user whose income is too low to afford a median-income rental apartment.

How many would qualify?

According to the CBO report, in 2014 the federal government provided about $50 billion in housing assistance to 4.8 million low-income households. But we have 20 million eligible households (those earning less than 50% of Area Median Income), so we still have 15 million very-low- income households that receive no assistance.

And what about those between 50% and 100% of median? Families earning $30,000 to $60,000 dollars? According to a 2015 report from Harvard’s Joint Center for Housing Studies, 20 percent of households earning $45,000–$74,999 (median area income range) were cost burdened in 2014.

The term “cost burdened” typically refers to those paying more than 30 percent of income on housing expenses, including utilities. In my opinion, that definition should be raised to 35 percent or 40 percent.

New System:

Now let’s design a system to provide funds directly to the end user– the household or person needing the assistance. Note that I said “directly.” Let’s cut out the middlemen. Let’s keep it simple. Basically, the recipient needs to prove his/her income, perhaps with an income tax return.

Households whose incomes are below national median income (adjusted for family size) will receive a stipend to supplement their incomes to the point that they can afford a median income rent (i.e. 30 percent of national median income.) This stipend will allow renters to go to any apartment in the country and rent whatever they want and wherever they want.

Assume national median income is $55,000. (In 2015, it was $55,775, per US Census.) Affordable rent for a median-income household of four is $1375 per month. ($55,000 /12 x .30)

So, let’s make sure every household can pay $1375 (adjusted for household size).

For instance, if the household earns only $40,000, it can afford $1167 without being overburdened. That household would receive a monthly stipend of $208. ($1375-$1167)

What if the household lives in a high-income area? Let’s take Dallas as an example.

Median income is $71,700, so median income rent is close to $1,800. This same household would have a choice: Stay in Dallas and pay an extra $450 out of pocket (The difference between national median rent and Dallas median rent) or move to a more affordable community. Again, it’s a choice.

The point is: instead of spending billions of dollars on bureaucracy and expensive production, give the money to the end users. Let them decide their own priorities. Proximity to work? Superior school system? Or maybe someone just likes a blue building. Whatever. The recipients may decide to spend more (or less) than 35% of their income on housing (like our Dallas household). That’s OK.

They can’t do that now with a HUD housing voucher. HUD restricts the amount they can pay, so they have no choice of lifestyle or location, or even the number of bedrooms, for that matter.

Employment- a very important issue

I’m talking here about low-income wage earners. There’s no employment requirement to receive HUD housing vouchers. In fact, the CBO report refers to studies that indicate receipt of a voucher reduces both household employment and earnings. About one-half of HUD’s housing voucher and public housing recipients are of work age and able-bodied, but only half of those count work as a majority of their income. Their other income comes from supplemental non-housing assistance.

In my plan, to receive the proposed stipend, households must show a willingness to work, preferably in a full-time capacity. But, per the report, the cost to wean recipients off housing assistance will cost about $10 billion. (more bureaucracy/administration?)

What has happened to common sense? Our voluminous legislative regulations, encouraged by special interest groups have us so tied up in “programs” that we are failing the working American family. There’s a lot of talk about adjusting programs, but I am talking about eliminating them.

Of course, my broad-brush vision is just that – a general concept. But it is based on my thirty-five years in the multifamily industry, as LIHTC developer, manager and now, investor. I think the number crunchers will show it can work. To get from here to there, however, will not be an easy task.

Christopher Finlay is Chairman/CEO of Lloyd Jones Capital, a private-equity real-estate firm that specializes in the multifamily sector. With 35 years of experience in the real estate industry, the firm acquires, manages and improves multifamily real estate on behalf of its institutional partners, private investors and its own principals. Headquartered in Miami, the firm has operations throughout Texas, Florida and the Southeast. For more information visit: lloydjones.wpengine.com.

Wait…There’s a better solution.

Interest rates are plunging around the world; some are even closing below zero. And with negative and minimal inflation, the real interest rates are also pushing 0%.

A June 9th Financial Times article on negative rates stated “Lenders in Europe and Japan are rebelling against their central banks’ negative interest rate policies with one big German group going so far as to weigh storing excess deposits in vaults.” And some fund managers are telling clients to keep their cash “under the mattress”! Wow!

It’s understandable when you see real interest rates. A recent Wall Street Journal article included an interesting chart of selected government bond yields. To calculate a real interest rate, economists subtract inflation from the nominal yield – thus the economic struggle between yields and inflation. And on June 10th, the 10-year US Treasury yield fell to its lowest close in 3 years. (At this writing, after Brexit, the 10-year Treasury has fallen below 1.50%.)

No wonder some banks are considering storing money in vaults! Now, compare those returns to direct multifamily investment. With a conservative 60% leverage, a good multifamily real estate investment can earn 8% returns with minimal downside risk. Plus, real estate is a strong hedge against interest rate changes and inflation.

Wise investors are beginning to recognize the value of multifamily real estate investment. In light of this (sometimes negative) interest-rate scenario, it’s time to assign a portion of your investment portfolio to solid multifamily real estate in high growth markets with, of course, conservative leverage.

Look at the Harvard University endowment. Its fiscal 2015 real estate portfolio was its highest returning asset class, at 19.4%. And Yale’s legendary endowment fund, which has consistently outperformed its counterparts, attributes its success to its alternative assets.

Duplicating Harvard’s results going forward is unlikely. But multifamily assets can produce easily an 8% yield and a conservative 16% IRR over the next seven-to ten-year period. And, with depreciation, they will provide a significant tax advantage for the individual investor.

Granted, these investments are not available on your Bloomberg terminal, unless you want to invest in REITS, which are like stock. Even REITS can produce 4% returns and offer liquidity, but the after-tax returns will be substantially less than a good multifamily direct investment. An experienced real estate investment specialist will guide you through the investment process. Be sure that firm has a strong operations arm. Operations is the key to property performance.

So what is the proper allocation? In my opinion, you need 20% in direct, multifamily real estate investment. (Harvard’s real estate commitment for 2016 is between 10% and 17%. Yale University allocated 17.6 percent to real estate in 2014.) After that, I’d suggest 40% stocks; 30% bonds; 10% alternatives.

In all my years (35 in this business) I have never seen such a disparity between yield on the 10-year Treasury and a quality multifamily asset. You’ll notice that I stress “multifamily.” I would be extremely cautious about retail and office investment. But nothing makes more sense than direct multifamily investment. The demographic demand is unprecedented. And everybody needs a place to live.

Christopher Finlay is Chairman/CEO of Lloyd Jones Capital, a private-equity real-estate firm that specializes in the multifamily sector. With 35 years of experience in the real estate industry, the firm acquires, manages and improves multifamily real estate on behalf of its institutional partners, private investors and its own principals. Headquartered in Miami, the firm has operations throughout Texas, Florida and the Southeast. For more information visit: lloydjones.wpengine.com.

The West Coast is different. It’s entrepreneurial; it’s leading edge, and it’s full of big ideas. So I headed west to LA to pick the brains of the big guys – some of the smartest in the real estate investment industry. I visited three large real estate funds and two very large family offices. Here’s my take-away.

At Fund #1, the managing director was lamenting that over the past two years, they have acquired only one multifamily investment. In retrospect, he said he wished they had bought more, because it has been their best performer of all real estate asset classes.

When I asked why they had bought only one, he admitted he couldn’t get his head around the prediction that rent growth would be in the 3% to 5% range. Consequently he had presumptively marked his proforma down to a lower number, and the returns were not as good. Surprise!! In hindsight, even those aggressive assumptions have turned out to be conservative. In fact, in many cases, those rent growth numbers have been exceeded.

My take-away:

Obviously, last year he was premature in his concern about rent growth, but he may be right on target for the next several years. In my opinion, multifamily rent growth will be hard to maintain, especially in A and B product. That is, of course, unless – or until – inflation raises its ugly head.

There may be a little room left in C product, but that will hinge more on the ability to pay than on demand. Demand will be insatiable, but already, almost 50 % of all renter households are rent “burdened” (spending more than 30% of income on housing costs).

Major Fund #2 voiced concern that we’re at the top of the market. To confirm his position, he pointed out his office window to a 100,000 square foot spec home under construction. With a $500 million price tag, this home is the highest priced residence in the world. And it’s a spec building! It does make one pause.

Nevertheless, after recently raising substantial funds from one of the big California pension plans, he agreed that multifamily still makes sense. But he added a caveat: It is critical to underwrite the investment very carefully in order to weather any future downturn.

My take-away:

I couldn’t agree more. We need to go into our investments with the mindset to ride out any storm. The multifamily demographics are so overwhelming that I am certain any storm will be a short one, but like all storms, if you are not prepared, it can mean death.

#3 Fund is a multi-billion dollar fund that invests in all asset classes and all around the world. This fund is still very bullish on U.S. multifamily, but it has substantially reduced its return metrics to what is achievable in this market.

My takeaway:

How on earth do these guys expect to deploy all that capital? They, like so many other funds, are collecting billions of dollars for real estate investment. Everybody wants real estate. But where do they find enough assets – and good deals – for all that capital? This is not a distressed situation. Assets are for sale, but at what price? It’s hard to find a really good multifamily real estate investment – primarily because people are paying too much, or at least more than rents can justify.

Another thing we have to consider: A lot of major pension funds are now at the exit stage of previous investments made five to seven years ago. And they have been reaping huge profits. That capital will have to be re-deployed into real estate investments.

Family Office

Finally, we visited a billion dollar family office.

Real estate – specifically multifamily real estate – will be this group’s major investment focus going forward. In the past its investments were spread over all asset classes. This group confided that it now realizes that multifamily provides, without question, the best return metrics in terms of both cash flow and IRR.

In summary, it was a great week with the big boys. It’s always fun to learn how those West Coast brains work. I was happy to see that we are in agreement on most issues.

My final take-away is that my meetings confirmed what I have been preaching for some time:

• Look for C and B product in good neighborhoods. This is still the best possible real estate investment.

• Do not over-leverage.

• Remember that operations/property management is key.

• Be realistic about rent growth.

• Underwrite to weather any upcoming storm.

• Avoid the buying frenzy; be patient; and keep underwriting everything to find the right deal.

Then you will have a safe investment with excellent returns.

Christopher Finlay is Chairman/CEO of Lloyd Jones Capital, a private-equity real-estate firm that specializes in the multifamily sector. With 35 years of experience in the real estate industry, the firm acquires, manages and improves multifamily real estate on behalf of its institutional partners, private investors and its own principals. Headquartered in Miami, the firm has operations throughout Texas, Florida and the Southeast. For more information visit: lloydjones.wpengine.com.