Investors are always encouraged to have a well-diversified portfolio. This includes investments in different assets with different risk profiles – and not just traditional stocks and bonds. Many investors will eventually add alternative investments to their portfolio. One of the most popular alternative investments is commercial real estate.

Commercial real estate comes in many shapes, sizes, property types, and forms. There are small, individual rental properties such as single-family rental homes. At the other end of the spectrum, there are 500+- unit apartment buildings, commercial office towers, hotels, retail strip centers, senior living facilities, industrial warehouses, and more. The diversity of the sector is one of the reasons it attracts so many investors. There is a property type to meet the risk tolerance of virtually every investor, regardless of how much capital they have at the ready.

That said, the breadth of commercial real estate can be overwhelming to those who have never invested in this asset class before. Today, we provide a brief primer about commercial real estate, including the pros and cons of investing in the sector.

RELATED: Why You Should Add Commercial Real Estate To Your Investment Portfolio

What Is Commercial Real Estate?

Commercial real estate refers to any income-generating property. It can include residential (i.e., multifamily) properties as well as properties used for business activities (e.g., office buildings, hotels, retail centers, warehouses, senior-living facilities and more).

On the residential side, any property with 1- to 4-units is considered “residential” property. It is only when a property has 5+ units that it becomes classified as “commercial” property and therefore, must seek a commercial loan instead of a more traditional residential mortgage.

Commercial real estate can be owned individually, by groups, or by companies organized to oversee the investment on others’ behalf.

Most people invest in commercial real estate as a way of earning consistent cash flow and/or to earn a return after a property has appreciated in value. Ideally, they earn income both ways. There are also tax benefits associated with owning real estate, another financial benefit described in more detail below.

We find and create investment opportunities for our partners. Learn more about what we do here at Loyd Jones.

The Pros and Cons of Investing in Commercial Real Estate

There are many benefits associated with investing in commercial real estate. However, despite the benefits, there are some drawbacks, as well. We explore these pros and cons below.

- Pro: Portfolio Diversification. Adding commercial real estate to one’s portfolio is a great way to diversify away from traditional stocks, bonds, and mutual funds. This is because real estate generally has a low correlation with the stock market. The stock market tends to ebb and flow, sometimes dramatically, even on a daily basis. Real estate value takes longer to respond to economic turmoil, and therefore, is less likely to experience regular volatility. Those looking for stable investments will often invest in commercial real estate as a way of otherwise mitigating their portfolio’s risk.

RELATED: Does The Stock Market Scare You?

- Pro: Asset Diversity. As noted above, commercial real estate is a large sector with many product types of varying sizes and scales. Someone looking to further mitigate portfolio risk can do so by investing in real estate of varying risk profiles. For example, ground-up development (i.e., “opportunistic” development) is considered the riskiest of all real estate deals. Investing in a stabilized, core asset is much “safer” though the costs will be higher, and returns will be lower. Investors might decide to invest their capital proportionately depending on their specific risk tolerance and investment horizon.

- Pro: Ability to Leverage. A primary draw to investing in commercial real estate is the ability to use leverage (i.e., financing) to fund the acquisition and/or redevelopment of a property. This ability to leverage offers a real estate investor several advantages.

1) He can purchase more real estate with less of his own capital. (Note, the following examples are very simplistic and do not consider the effect of debt and other expenses. They are offered solely to illustrate the concept.)

- Assume he has $1 million to invest. He can put it all into one, $1 million purchase. Assume it increases 10%. He will have earned $100,000.

- Or with leverage, (i.e., a mortgage), his $1 million can probably buy a $3 million property. Assume it, also, increases 10%. Now he has earned $300,000 with his same $1 million investment.

- As another option, instead of buying a more expensive asset, he could invest in several With leverage, his $1 million investment capital could buy three $1 million properties. Again, assuming the properties all increase in value by 10%, he will earn $100,000 on each one for a total of $300,000. Again- with that same $1 million investment.

2) He can spread his investment risk across multiple properties.

If this same investor purchases several assets, he spreads his risk by not putting all his eggs in one basket. If one doesn’t perform to expectations, his capital is still protected by the others – which hopefully will compensate for any loss in the unsuccessful one.

3) At the same time, as the property value increases, so does the investor’s equity in the asset.

4) But investors must be aware that leverage also carries risk if the value of the property/ies declines. Leverage must be used with prudence.

RELATED: Why Is Real Estate The #1 Long Term Investment For Americans?

Pro: Passive Income. Most of those who invest in real estate do so as passive investors. In other words, they invest their capital with a sponsor or development partner (the “general partner”) who then oversees the transaction on the investors’ (the “limited partners”) behalf. GPs earn a premium for their role in spearheading the deal, but the LPs are free to go about their daily business while still earning passive income. This passive income usually takes the form of cash-flow distributions that are paid out on a monthly or quarterly basis.

- Pro: Appreciation Potential. While there is no guarantee that real estate will appreciate in value, historically, long-term investors will realize some gains associated with the property upon stabilization and re-sale. While real estate values may ebb and flow over the course of an individual real estate cycle, over multiple cycles, values typically climb upward.

- Pro: Multiple Investment Vehicles. There are many ways to passively invest in commercial real estate, including but not limited to investing in REITs, syndications, or real estate funds.

The most conservative investors may opt to invest in a publicly traded real estate investment trust (REIT). When investing in a REIT, you are purchasing a share of the company that owns the investments held by that REIT—you are not purchasing shares of the real estate asset itself. The benefit to investing in a publicly traded REIT is that, like buying stocks or bonds, shares are liquid and can be easily purchased or sold with little to no investment minimum.

Meanwhile, other investors might opt to invest in a syndication or fund. A syndication is an entity formed for the purpose of aggregating capital to invest in a specific real estate deal. A syndication is overseen by a sponsor, or general partner, who usually has some degree of its own capital invested in the deal as well. The sponsor collects certain fees for managing the deal on investors’ behalf, and often earns bonus payments (“promotes”) based upon certain success metrics. Most syndications will have a minimum investment amount, but that may be as low as $50,000 or less.

Similarly, a real estate fund is a way for sponsors to aggregate capital to invest in one or several assets, some of which may not yet have been identified. For example, a sponsor may raise a $50 million fund to strategically deploy based on certain investment criteria. It might focus on value-add multifamily deals in outer-urban markets. Those who invest in a fund are putting faith in the sponsor to identify appropriate deals and then execute their business plans accordingly (vs. those who invest in a syndication who have a better sense for what an individual deal will entail).

- Pro: Tax Benefits. Real estate is a highly tax-advantaged industry. Investors are able to offset their earnings through what’s known as “depreciation.” Depreciation is an annual tax deduction that the IRS allows owners to take as “a reasonable allowance for exhaustion or wear and tear, including a reasonable allowance for obsolescence.” Only the value of buildings can be depreciated, including eligible appliances, fixtures, and equipment. Land is not considered depreciable.

Depreciation is generally based on the “useful life” of a property. The IRS has deemed residential real estate to have a 27.5-year lifespan. Commercial property has a 39-year lifespan. Of course, most properties will still be standing well after their “lifespans” – but they will likely need significant improvements during this time in order for the property to remain competitive and lucrative. Depreciation is intended to offset the costs associated with these improvements, thereby preventing the property from becoming obsolete.

In reality, many properties appreciate in value while simultaneously being depreciated each year. Depreciation is effectively a paper loss used to offset the actual gains earned from the asset. This lowers an investor’s tax burden without impacting profits.

Some investors will also utilize what’s known as a “cost segregation” study as a way of accelerating depreciation. Rather than depreciating the asset equally each year, a cost segregation study assigns a useful life to each individual building component, which allows an owner to frontload depreciation in the first few years of ownership, which puts money back into investors’ pockets sooner. These “losses” often exceed the earnings from any given year and may be applied to prior year earnings or carried forward and applied to future earnings.

Real estate investors can also utilize something known as a “1031 exchange,” which allows investors to roll the proceeds from the sale of a real estate asset into another “like kind” property of greater value. Those who do this are able to defer paying capital gains tax. Many will continue to leverage 1031 exchanges in perpetuity to continue growing their real estate portfolios. They can then pass down the real estate to their heirs at a stepped-up basis, which again, results in significant tax savings.

- Con: Illiquid Asset Class. One drawback to investing in commercial real estate is that it is an illiquid asset (unless one invests in a publicly traded REIT). The time it takes to conduct due diligence, acquire, close on, and then stabilize a property can take months if not years. Therefore, real estate does not trade as quickly and easily as other asset classes. This means that real estate investors often have large tranches of their capital tied up for years at a time.

- Con: Market Risks. While commercial real estate has historically performed well relative to other asset classes, it is not a foolproof investment. Its performance is still subject to market risks that could impact the property’s value. Market risks include changes in rental rates, interest rates, property taxes, and absorption rates. These changes can happen quickly and unexpectedly, so investors must be sure their pro forma has sufficient padding to absorb potential financial hits like these. Experienced investors should be able to anticipate these changes well before they occur, but occasionally, black swan events like the pandemic are beyond the realm of what investors might have imagined.

RELATED: Strategies For Collecting Rent Payments During A Crisis

- Con: Limited Control. Those who invest in a REIT, fund, or syndication usually have very little direction over how real estate decisions are made. As passive investors, they are merely contributors of capital. All decisions are otherwise made by the sponsor or operating entity overseeing the transaction on investors’ behalf. This requires investors to put significant faith in the company with whom they invest – faith that that company has the knowledge, resources, and experience to execute their business plans as originally intended.

Is Commercial Real Estate a Good Investment?

As you can see, there are many benefits associated with investing in commercial real estate, regardless of what type of property you select. These benefits are becoming more widely known, and in turn, real estate is increasingly becoming more of a mainstream investment (compared to an “alternative” investment in decades past). This is especially true now that institutional investors are adding commercial real estate to their portfolios at record speed. In turn, demand for commercial real estate is hovering at all-time highs.

The outlook for commercial real estate remains strong, for some product types more than others. For example, multifamily demand continues to outpace demand for office, hospitality, and retail. Senior housing is also anticipated to outperform other sectors as the baby-boomer generation ages and seeks age-restricted and supportive housing of all kinds.

If you are considering adding commercial real estate to your portfolio, contact us today. Our value-add investment platform has opportunities for investors of all kinds. We would be happy to match you with opportunities that best suit your specific investment needs.

We provide quality housing that makes lives better. Meet the people that make the difference at Lloyd Jones.

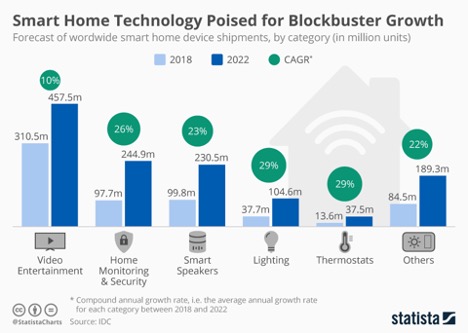

Source: https://www.statista.com/chart/15736/smart-home-market-forecast/

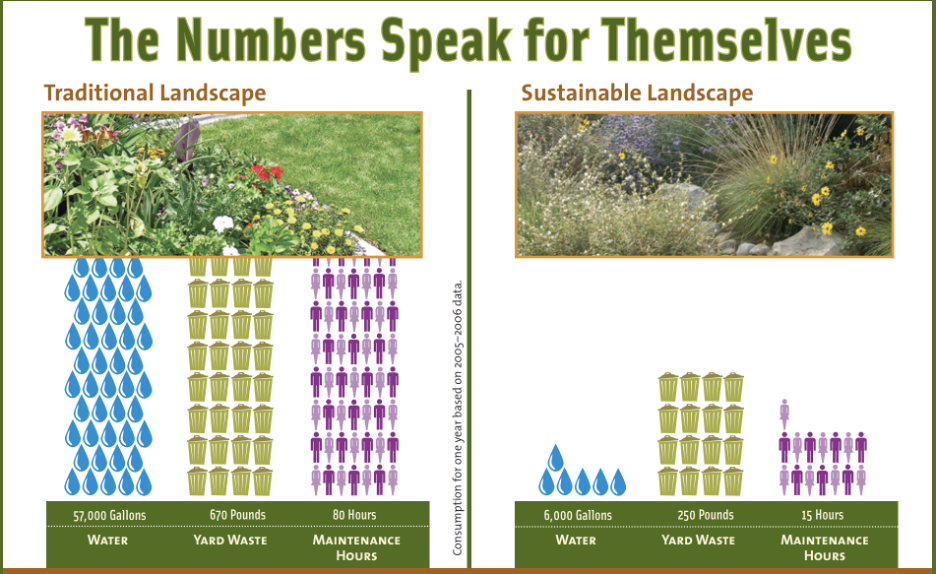

Source: https://www.statista.com/chart/15736/smart-home-market-forecast/ Source: https://www.smgov.net/uploadedFiles/Departments/OSE/Categories/Landscape/GG.DisplayAd5.e.res%281%29.pdf

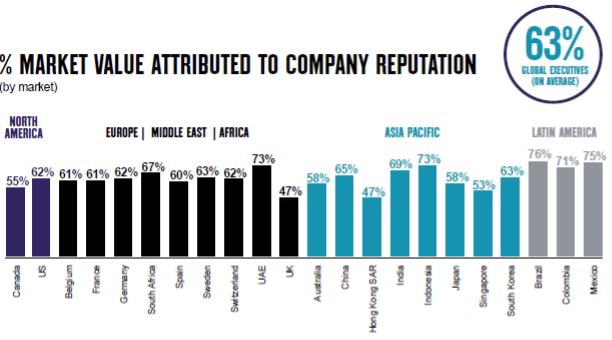

Source: https://www.smgov.net/uploadedFiles/Departments/OSE/Categories/Landscape/GG.DisplayAd5.e.res%281%29.pdf Source: https://cuttingedgepr.com/good-corporate-reputation-is-vital-especially-during-covid-19-times/

Source: https://cuttingedgepr.com/good-corporate-reputation-is-vital-especially-during-covid-19-times/